Loading banners

NEWS EXPRESS is Nigeria’s leading online newspaper. Published by Africa’s international award-winning journalist, Mr. Isaac Umunna, NEWS EXPRESS is Nigeria’s first truly professional online daily newspaper. It is published from Lagos, Nigeria’s economic and media hub, and has a provision for occasional special print editions. Thanks to our vast network of sources and dedicated team of professional journalists and contributors spread across Nigeria and overseas, NEWS EXPRESS has become synonymous with newsbreaks and exclusive stories from around the world.

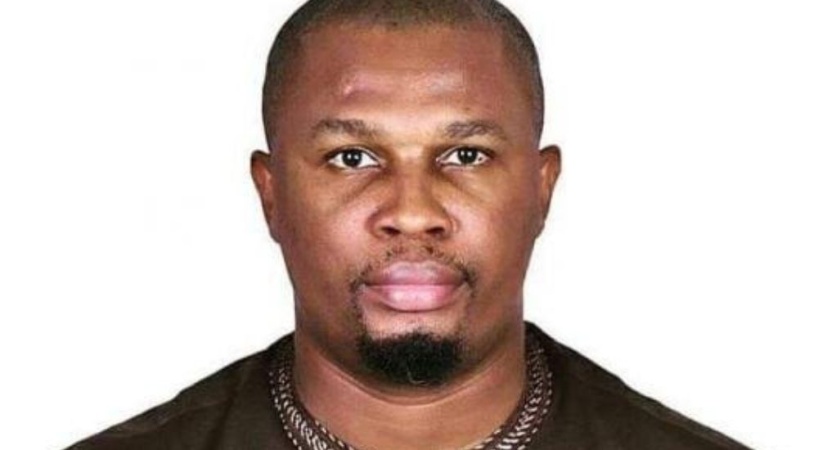

Sen Asuquo Ekpenyong sponsored the Factoring Regulation Bill

The Senate on Wednesday, passed for second reading, a Bill seeking to create a legal framework enabling Small and Medium-sized Enterprises (SMEs) to access quicker financing by converting unpaid invoices into immediate cash.

The proposed legislation, titled ?Factoring Regulation Bill, 2024,? was sponsored by Senator Asuquo Ekpenyong (APC ? Cross River South), who said it is designed to tackle delayed payments, one of the most persistent challenges confronting micro, small, and medium enterprises (MSMEs) across Nigeria.

Ekpenyong explained that many MSMEs deliver goods or services and then wait up to 90 days before receiving payment, leaving them unable to pay workers, replenish inventory, or expand operations.

?This cycle of weak cash flow not only traps small businesses but also slows down our economy?s overall growth,? he said.

The lawmaker described the Bill as a major structural reform that would unlock working capital for over 40 million small businesses that form the backbone of Nigeria?s economy.

He said factoring, the practice of selling verified invoices to a licensed finance company or bank at a small discount in exchange for immediate payment, offers a tested solution to the cash-flow challenges faced by MSMEs in the country.

?Unlike a bank loan that depends on collateral, factoring is based on the buyer?s creditworthiness and the validity of the invoice.

?This allows businesses to access financing on the strength of their sales, not their fixed assets,? he said.

The senator said the Bill provides a comprehensive regulatory structure under the Securities and Exchange Commission (SEC), ensuring that only licensed entities can engage in factoring while also mandating full disclosure of costs and fees.

It also makes invoice transfers legally enforceable to prevent disputes and aligns with digital reforms such as e-invoicing and receivables registries that reduce fraud and improve verification.

Ekpenyong added that the framework would encourage large corporations and government agencies to adopt supplier-financing programmes that enable MSMEs to receive early payments at low cost.

Citing global precedents, he noted that similar policies in countries such as Mexico, India, Chile, Brazil, and South Africa had unlocked billions of dollars in working capital for small businesses, strengthening domestic value chains.

He expressed optimism that with clear regulations, Nigeria could attract over $1 billion annually through factoring to support production, create jobs, and boost investor confidence.

?This is not another short-term credit scheme. It is a structural reform that converts invoices MSMEs already hold into usable capital,? he explained.

The Bill, which was first read on June 11, 2024, also mandates regular reporting on transaction volumes, delinquency trends, and MSME participation, while promoting financial literacy through plain-language contracts and standard term sheets.

The Bill was approved for second reading by voice vote and referred to the Senate Committee on Banking, Insurance, and Financial Institutions for further legislative action and to report back in four weeks. (The Nation)