Loading banners

NEWS EXPRESS is Nigeria’s leading online newspaper. Published by Africa’s international award-winning journalist, Mr. Isaac Umunna, NEWS EXPRESS is Nigeria’s first truly professional online daily newspaper. It is published from Lagos, Nigeria’s economic and media hub, and has a provision for occasional special print editions. Thanks to our vast network of sources and dedicated team of professional journalists and contributors spread across Nigeria and overseas, NEWS EXPRESS has become synonymous with newsbreaks and exclusive stories from around the world.

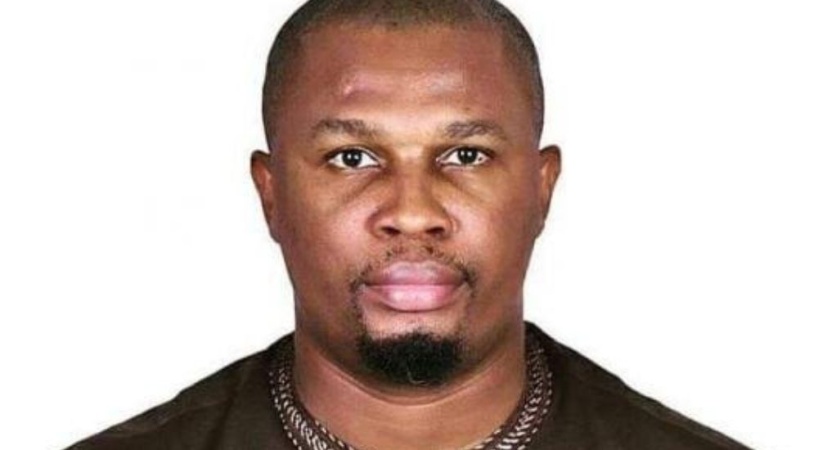

Olayemi Cardoso, Governor of the Central Bank of Nigeria CBN

The Central Bank of Nigeria (CBN) has said that the ongoing recapitalisation of Nigerian banks is part of efforts to strengthen the financial system and position it to support the country?s ambition of building a $1 trillion economy.

CBN Governor, Mr. Olayemi Cardoso, disclosed this at the CBN Fair held in Calabar, Cross River State, explaining that the move would make Nigerian banks more resilient, globally competitive, and better equipped to finance large-scale investments in key sectors of the economy.

Represented by Mr. Tobias Uche, Assistant Director, Corporate Communications Department, Cardoso said the recapitalisation drive forms a key component of the apex bank?s broader strategy to enhance financial stability, deepen inclusion, and promote sustainable economic growth.

?The recapitalisation exercise is designed to strengthen the resilience of Nigerian banks and prepare them to finance the growth of a $1 trillion economy,? he stated.

Cardoso highlighted that the CBN has introduced several reforms, including exchange rate unification, the B-Match foreign exchange trading system, and the Nigeria Payments System Vision 2028 (PSV 2028), aimed at accelerating digital transformation and promoting safer, faster, and more efficient transactions across the financial ecosystem.

He noted that ongoing monetary and fiscal coordination efforts were beginning to yield positive outcomes, with foreign exchange stability improving and inflation showing signs of gradual moderation.

In her remarks, the CBN Calabar Branch Controller, Jibunoh Nwanneamaka, said the apex bank is expanding the use of alternative payment channels to drive financial inclusion, particularly among rural dwellers and the unbanked population.

?Mobile money, USSD, POS, internet banking, QR codes, and digital wallets are not just conveniences; they are lifelines for millions of Nigerians excluded from formal banking,? she said.

Also speaking, the Special Adviser to the Cross River State Governor on Agriculture, Prof. John Shiyam, commended the CBN for what he described as a people-focused initiative that aligns with the state?s efforts to empower farmers and boost food security.

?Many local governments in Cross River still lack commercial banks, making it difficult for farmers to access credit. This initiative will bridge that gap,? Shiyam noted.

The CBN Fair, themed ?Driving Alternative Payment Channels as Tools for Financial Inclusion, Growth and Accelerated Economic Development,? brought together stakeholders, traders, and students to discuss monetary policy, consumer protection, and the Bank?s latest innovations in digital payments. (The Guardian)