Loading banners

NEWS EXPRESS is Nigeria’s leading online newspaper. Published by Africa’s international award-winning journalist, Mr. Isaac Umunna, NEWS EXPRESS is Nigeria’s first truly professional online daily newspaper. It is published from Lagos, Nigeria’s economic and media hub, and has a provision for occasional special print editions. Thanks to our vast network of sources and dedicated team of professional journalists and contributors spread across Nigeria and overseas, NEWS EXPRESS has become synonymous with newsbreaks and exclusive stories from around the world.

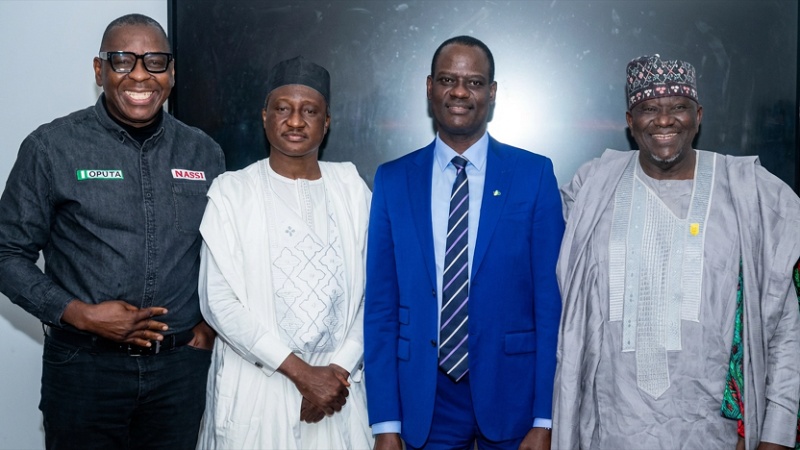

Olayemi Cardoso, Governor of the Central Bank of Nigeria CBN

By GRACE ALEGBA

Mr. Olayemi Cardoso says the bank?s reforms are aimed at stabilising the economy, restoring confidence and bringing inflation down to single digits in the medium term.

Cardoso said this while taking questions during a fireside chat at his inaugural lecture series at the Lagos Business School (LBS).

The lecture had the theme ?Next Generation Leadership in Monetary Policy and Nation Building? and marked the launch of the CBN Governor?s Lecture Series.

The lecture had in attendance students from various tertiary institutions, members of academia, bankers and industry experts.

Cardoso explained the challenges of stabilising the nation?s economy and how hard work and credibility had helped CBN to redirect the nation?s economy on a positive growth path.

He explained ongoing reforms and achievements in the last two years geared toward stabilising the economy and restoring investor confidence.

?The idea is to ensure that in the medium term we achieve single-digit inflation,? he said.

He said interest rates and the foreign exchange market were areas of concern for everyone, adding that, at one point in time, the foreign exchange market had multiple challenges.

He explained the crisis of access to foreign exchange when he assumed office two years ago and efforts through necessary and stringent reforms that restored sanity, transparency and credibility.

He said credibility is at the heart of any central bank to win people?s trust and investor confidence, while listing some benefits of the reforms, including the ability of citizens to use Naira debit cards abroad.

Cardoso said when he promised to clear verifiable FX backlog estimated at over seven billion dollars, the feat was a daunting task which credibility, transparency and resilience helped him to achieve.

He said promises must be kept for people to keep trusting the nation?s economy, adding that people invest where there is integrity, credibility and trust, and that transparency and credibility restored sanity and attracted foreign investors.

Cardoso said during his tenure the apex bank began publishing financial statements, a practice that had been suspended for several years.

?For years, the financial statements of the Central Bank had not been published. We have gone ahead to publish it. It?s on our website,? he said.

He also explained how CBN used technology to eliminate sharp practices, citing adoption of a new electronic matching system, which made market activities open and transparent.

According to him, beyond macroeconomic stability, vision building involves creating opportunities for young people, in particular areas like financial inclusion and support for small and medium-scale businesses.

Cardoso said he was not seeking to praise himself but urged Nigerians to read positive comments of various local and international rating agencies about the efforts of the bank under his leadership.

Earlier, while delivering his keynote, he insisted that the CBN is building an institution that can be trusted, while urging the youths to embrace credibility.

Cardoso said the inaugural lecture initiative was aimed at deepening public understanding and strengthening the transmission of monetary policy.

The governor said the country?s most important asset is its next generation, which forms the largest demographic comprising more youths who must be groomed to drive the nation?s future development and growth.

He said when he assumed office as governor in 2023, Nigeria?s economy faced formidable headwinds with high inflation rates, depleted external reserves, low investor confidence, and nearly every macroeconomic indicator under pressure.

Cardoso said he tackled inflation with tightening policy aggressively, raising rates by more than 800 basis points and strengthening liquidity management.

He explained other reforms including strengthening reserves, now standing above 42 billion dollars, and new channels for diaspora remittances and investments.

?On financial inclusion, we expanded mobile and agency banking to underserved communities, raising access from 56 per cent in 2020 to over 64 per cent in 2025, and commenced the recapitalisation of banks to ensure a stronger, more resilient financial system,? he said.

He said the nation?s inflation, which peaked at almost 35 per cent, moderated to about 20 per cent, adding that real GDP expanded by 4.2 per cent in the second quarter, signalling a re-emergence of growth momentum.

The apex bank boss also explained the future of digital payments, credit, savings, investment and others being redefined by fintech and digital platforms.

Prof. Olayinka David-West, Dean, Lagos Business School (LBS), Pan-Atlantic University, delivering a welcome address, explained the role of the institution since inception in 1991.

She praised the partnership with the CBN governor to foster thought leadership, policy engagement, and in-depth discourse between town and gown. (NAN)