Loading banners

NEWS EXPRESS is Nigeria’s leading online newspaper. Published by Africa’s international award-winning journalist, Mr. Isaac Umunna, NEWS EXPRESS is Nigeria’s first truly professional online daily newspaper. It is published from Lagos, Nigeria’s economic and media hub, and has a provision for occasional special print editions. Thanks to our vast network of sources and dedicated team of professional journalists and contributors spread across Nigeria and overseas, NEWS EXPRESS has become synonymous with newsbreaks and exclusive stories from around the world.

Ahead the Monetary Policy Committee (MPC) meeting, slated for November 23 and 24, two economists have urged the CBN to reduce the interest rate and the Cash Reserve Requirement (CRR) of banks, to forestall obstacles to acquiring loans.

They told the News Agency of Nigeria (NAN) in separate interviews on Thursday in Lagos that reduction in interest rates and CRR was necessary to make funds available to investors for borrowing.

The experts spoke against the backdrop of the Monetary Policy Committee (MPC) meeting, slated for November 23 and 24.

Prof. Sheriffadeen Tella of the Department of Economics, Olabisi Onabanjo University, Ago-Iwoye in Ogun, said there was need for the MPC to reduce the interest rate charged by commercial banks.

Tella explained that it was becoming difficult for businessmen and investors to access funds for their businesses because of the high interest rate charged by banks.

According to him, the MPC should also reduce the CRR of commercial banks to enable them have more funds for borrowing.

“There is need for the MPC to reduce the CRR of banks to create more money for borrowing.”

On the call for the further devaluation of the naira, Tella lauded the CBN for professionally resisting the call by the IMF for Nigeria to devalue its currency.

He noted that the decision of the apex bank on the naira was worthy of commendation, adding that the forces of demand and supply should be allowed to stabilise the naira.

In his contribution, Dr Evans Osabouhien of the Department of Economics and Development Studies, Covenant University in Ota, Ogun, said the MPC should see the stability of the economy as key consideration.

Osabouhien suggested that the MPC should leverage monetary variables in the stimulation of the economy.

According to him, the MPC needs to do a re-evaluation of the compliance of the Bank Verification Number (BVN) to reduce the challenges encountered by bank customers.

He urged the MPC to monitor the compliance of ministries, departments and agencies of government to the Treasury Single Account to ensure transparency and equity.

The MPC was established by the CBN Act 2007, charged with the attainment of price stability and to support the economic activities of the Federal Government.

The committee, which is headed by the Governor of the CBN, is made up of 12 members.

According to the CBN, the MPC is the highest policy making committee of the bank with the following mandate: Review economic and financial conditions in the economy;

“Determine appropriate stance of policy in the short to medium term. Review regularly, the CBN monetary policy framework and adopt changes when necessary, among others.”

In the last MPC meeting, the CBN voted to reduce the CRR from 31 to 25 per cent.

It retained the MPR at 13 per cent, retained the symmetric corridor of 200 basis points around the MPR; and retained the liquidity ratio at 30 per cent. (NAN)

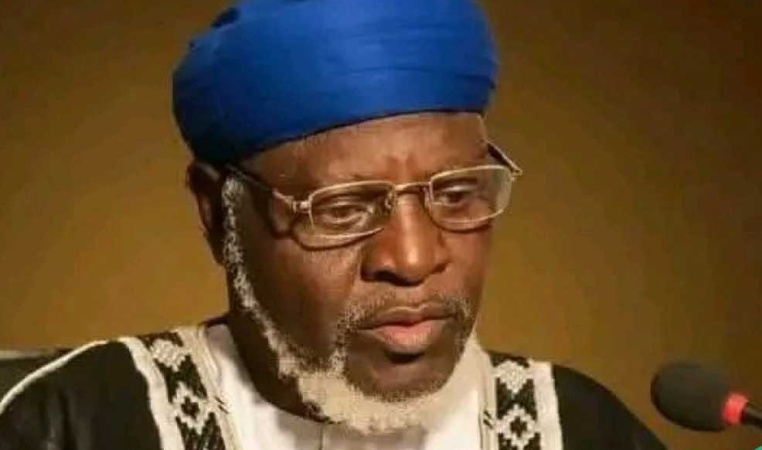

•Photo shows CBN Gov. Emefiele.