Loading banners

NEWS EXPRESS is Nigeria’s leading online newspaper. Published by Africa’s international award-winning journalist, Mr. Isaac Umunna, NEWS EXPRESS is Nigeria’s first truly professional online daily newspaper. It is published from Lagos, Nigeria’s economic and media hub, and has a provision for occasional special print editions. Thanks to our vast network of sources and dedicated team of professional journalists and contributors spread across Nigeria and overseas, NEWS EXPRESS has become synonymous with newsbreaks and exclusive stories from around the world.

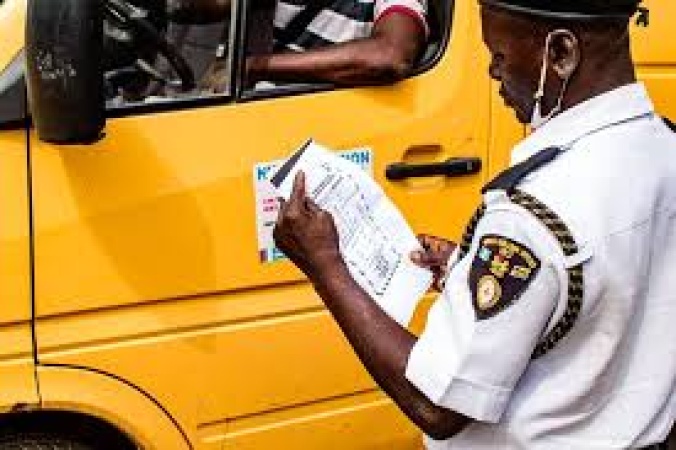

The Nigeria Customs Service (NCS) may have been troubleshooting the sustained foreign exchange (FX) market stability as it introduces a 7.3 per cent margin in the market, a charge that is already being considered as an unstructured tax on port users.

The trade facilitation agency has left the exchange rate for assessing tariffs and other charges at N1451.6/$, a band that is N98.8 above the spot rate and nearly a N100 premium on the weekly average official rate.

The crisis of confidence remained benign in January and early February. But with the alternative market traders’ quotes fast heading down to N1400/$, the NSC rate is increasingly wearing the toga of an outlier in a market touted to have considerably converged tightly around the Nigerian Autonomous Foreign Exchange Market (NAFEM).

It also puts the NSC forward as a third force in a market it is expected to operate passively, mirroring the spot rate or short-term average (weekly or monthly).

But some views inflating the naira from within suggest a more cautious NCS and a possible trade-off between alignment and fiscal protection.

During the infamous 2024 volatile trading era, the NSC shunned calls to anchor its benchmark on a monthly average to enhance predictability and stuck to sporadic rate adjustments under the guise of mirroring the daily movement of the official rates.

To catch up with changing spot rates, Customs adjusted the duty and other charge determination exchange rates at least 54 times or at least once a week. It was slightly less sporadic last year. Yet, the figure was changed over 30 times, according to data tracked by The Guardian.

The naira has gained significantly. But Customs, like the executive at which pleasure operates, is stuck to last year’s average rate. Lawmakers are expected to adjust this year’s budget FX benchmark as the N1512/$ set is behind the current market reality.

But even as of December, when the budget was prepared, the dollar was already trading at a significantly lower rate than the N1500/$ market. Also, there were already projections, even from the international market, that the naira was undervalued and that it could rally substantially going into the new year.

The dollar had not traded at N1450/$ or above as suggested by the current Customs rate this year. It closed January 2, the first trading day of the year, at N1434/$ and remained on a downward slope since then.

The divergence between the market value and the fiscal authority, which Customs and budget benchmark highlight, points to two possibilities: a growing official scepticism about the comeback of the naira after close to three years of debauching the currency or that the authorities are prioritising revenue stability.

Both cases may have been wrong about the government’s commitment to its promise to build an economy that supports gradual market correction, rising from an era of a concerning spike in headline inflation and exchange rate.

There are fears that parallel rate fixing could create a feedback loop that could upset the market and send conflicting signals on monetary policy direction. In extreme cases, it creates an impression of a possible disconnect between the monetary and fiscal policy and the efficiency of the authorities’ coordination.

Whereas the NCS, like every other agency that interfaces with foreign currency transactions, is expected to take the official exchange rate as it is, it reports to the Ministry of Finance, an institution that optimises the government’s cost and revenue.

The rally, which started off last year, seems to have entered a consolidation phase since January, even as February posts trading rates not seen since early 2024.

Last week, NAFEM, the unified exchange rate window, traded around a moving average (MA) of N1352.8/$ or N98.8 short of what port users pay as duty for good clearing at the ports, as well as other charges due to the government. At the end of the weekly trading, the naira closed on the downside at N1355.45/$ simple average – its worst performance in the week, but on the green as per weekly data analysis.

The local currency closed the first trading day of the previous week at an average of 1390.54$ but edged up to N1366.78/$ at the close of the week. The NAFEM data suggests the currency gained over N11 per dollar or about one per cent week-on-week.

Whether last week’s uptick was a blimp or real, the naira has remained considerably stable in the short run. Rising from around N1510/$ in the past year, the currency has clawed back over N150 per dollar.

Naira has also gained at the alternative market, which many analysts consider to be the mirror of the real exchange value of the currency. Last weekend, most black marketers quoted between N1425 and N1445 to a dollar. Should import duty rate be anchored on the parallel market spot rates, which the Central Bank of Nigeria (CBN) often dismissed as speculative, the NCS would be short-changing importers by nearly N17/$ on average, a ‘tax’ that may be feeding into the cost prices of imported consumables and raw materials.

At an average quote of N1435/$ and an inefficiency price of N80 on the official market, the parallel market is already perceived as overpriced, a challenge the CBN intends to address with the approval of bureau de change weekly access of $150,000 from NAFEM. The new policy thrust could close the spread between the two market segments to near zero, as recorded a few months ago, and in the early days of the FX reform and ring-fence the strange rate fixing as a major stand-alone market distortion.

The agency with significant market price influence has left its exchange rate at a level last seen since December, a decision that is already being interpreted as a recreation of the multiple rate regime or a sign that key government institutions along the transmission belt of a stronger naira do not trust the market and could be possibly shorting the local currency.

The NCS, by retaining outdated spot rates for import duty billing, is under-pricing the naira – a currency many economists consider undervalued. The currency has about 66 per cent of its value after it was de-pegged in 2023 to mark the pro-market FX management regime.

The premium charge by the NCS may have mirrored a silent but sustained institutional pessimism. In the past few years, the Federal Government had opted for the maximum of the volatile naira trading band. This year is not an exception, with the executive opting for an above N1500/$ exchange rate benchmark as at December when naira was already heading up to N1400/$, validating the widespread bet on a stronger naira going into 2026.

Using the purchasing power parity (PPP) metrics to estimate the fair value of the naira, the Managing Director of Financial Derivatives Company, Bismarck Rewane, insisted last month that the currency was undervalued by about 11 per cent.

Last week, a radical projection by Nigeria’s leading investor, Femi Otedola, bet on a N1000/$ condition on a plan by Dangote Petroleum Refinery to ramp up its output to cut the country’s demand for imported refined products.

But the government may be trading off the positive effect of a rising naira for more stable revenue streams. Last year, the NCS generated N7.28 trillion, surpassing its target by N697 billion. The Nigeria Revenue Service (NRS), which is taking over the revenue collection responsibility of the NCS with the commencement of the National Single Window (NSW), set a tough revenue target of N40.71 trillion for the 2026 fiscal year. This ambitious figure is a 44 per cent mark-up on the N28.3 trillion it recorded last year.

One of the dire consequences of overpricing the dollar to optimise revenue is the rising cost of imported goods that is passed to the citizens. For an import-dependent country like Nigeria, the possibility of higher prices has huge consequences for the cost of living and quality of life.

With many local manufacturers depending largely on imported input and intermediate goods that are not fully duty-free, The Guardian could not independently compute the percentage contribution of overstated duty to the current inflation trend. But an economist who has done extensive work on the complexity of the country’s inflation. Dr Uba Chiwuike said the concern causes a significant distortion.

But an inflated naira may not be worse than a zero-sum game after all. A higher cost of clearing, Chiwuike said, could trigger a higher level of under-declaration of imports, delays in shipment and informal trade practices, such as smuggling, which undermine both revenue growth and market efficiency.

“The continued use of an inflated rate also reflects a lack of institutional confidence in the naira’s current market appreciation. By maintaining a higher rate for tariff calculations, Customs appears to be hedging against the risk that the recent strength of the naira is temporary or unsustainable. This approach signals scepticism about the durability of the market rate, likely influenced by structural FX constraints, liquidity shortages and policy uncertainties,” he said.

He admitted that the practice could distort trade incentives, raise the cost of imports and highlight a gap between official calculations and market reality while suggesting the tendency to prioritise fiscal protection over alignment with current market valuations.

“Given that imported goods account for roughly 25 per cent of the CPI basket, the overstatement of the naira in Customs’ exchange rate of N1,451.6/$ contributes meaningfully to inflation. Compared with the official rate of less than N1,380/$, this overvaluation adds approximately 0.78 percentage points, representing about 5.15 per cent of the December 2025 headline inflation of 15.15 per cent. Relative to the parallel market rate of over N1,400/$1, the contribution is around 0.56 percentage points or about 3.7 per cent of headline inflation,” the economist estimated. (The Guardian)