Loading banners

NEWS EXPRESS is Nigeria’s leading online newspaper. Published by Africa’s international award-winning journalist, Mr. Isaac Umunna, NEWS EXPRESS is Nigeria’s first truly professional online daily newspaper. It is published from Lagos, Nigeria’s economic and media hub, and has a provision for occasional special print editions. Thanks to our vast network of sources and dedicated team of professional journalists and contributors spread across Nigeria and overseas, NEWS EXPRESS has become synonymous with newsbreaks and exclusive stories from around the world.

Nigerian businesses are now free from the repercussions of the country being labeled a non-cooperating and high-risk jurisdiction in the aspect of money laundering and terrorists financing.

This is because the Financial Action Task Force (FATF) has removed the country from the list of high-risk territories regarding money laundering and financing of terrorism.

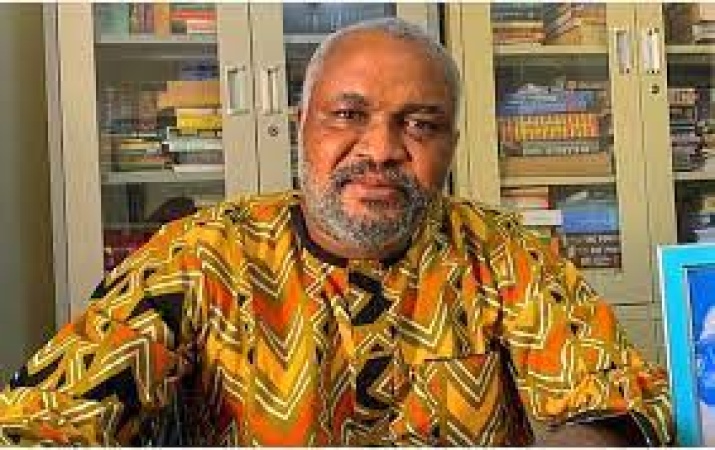

“It is expected that there will be great reduction in the costs and time line of financial transactions between individuals and institutions between Nigeria and other countries. Besides the guarantee of improved global rating for the country’s financial system, the amended laws and regulations will strengthen the enforcement and regulatory capacities of relevant institutions in Nigeria,” said Stephen Oronsaye, Chairman, Presidential Committee on Financial Action Task Force.

Oronsaye in a press release entitled “Nigeria Finally Exits FATF” attributed the FATF’s decision taken yesterday during its meeting in Paris, France, to Nigeria’s efforts geared towards tackling the crime of money laundering and financing of terrorism, including through measures to ensure national co-ordination. Said Oronsaye:

“The Financial Action Task Force (FATF) plenary has removed Nigeria from its Public Statement following the country’s full implementation of the mutually agreed Action Plan and the exhibition of a clear political commitment to continue the development of its Anti-Money Laundering/ Combating the Financing of Terrorism (AML/CFT) regime.

“The Financial Action Task Force (FATF) is an inter-governmental body established in 1989 by the Ministers of its Member jurisdictions. The objectives of the FATF are to set standards and promote effective implementation of legal, regulatory and operational measures for combating money laundering, terrorist financing and other related threats to the integrity of the international financial system.

“In a statement issued on Friday, October 18, 2013, in Paris, France, the FATF expressed satisfaction with the political will displayed by Nigeria in improving its Global AML/CFT Compliance.

“Accordingly, the FATF voted unanimously to expunge Nigeria from the list of jurisdictions.

“The FATF statement reads: “the FATF welcomes Nigeria’s significant progress in improving its AML/CFT regime and notes that Nigeria has established the legal and regulatory framework to meet its commitment in its Action Plan regarding the strategic deficiencies that the FATF had identified in February, 2010. Nigeria is therefore no longer subject to FATF’s monitoring process under its on-going global AML/CFT compliance process”.

“The FATF statement added that Nigeria will continue to address the full range of AML/CFT issues identified in its Mutual Evaluation Report.

“It will be recalled that during the recent on-site visit of the Regional Review Group (RRG) for Africa and the Middle East to Nigeria, the review team held meetings with the Minister of Finance, Attorney-General of the Federation, Office of the National Security Adviser and senior members of government departments, law enforcement agencies, the judiciary and regulatory authorities.

“The review team also noted Nigeria’s political commitment to continue to develop and strengthen the AML/CFT framework as was very clearly stated by the Ministers. The RRG team further observed that the government confirmed its resolve to ensure that the relevant agencies working on AML/CFT issues are adequately empowered through legal and financial resources to fulfill their roles.

“Critically, the Attorney-General of the Federation and Minister of Justice and the Minister of Finance also confirmed that the multi-agency Presidential Committee on the FATF (the chair of which has been the primary point of contact with the RRG throughout the ICRG process) would continue in existence as the national coordinating body for AML/CFT policy and implementation issues. It noted that all the respective agencies had a clear understanding of AML/CFT issues, and were able to show the extent to which procedures and resources were geared towards tackling the crime of money laundering and financing of terrorism, including through measures to ensure national co-ordination.

“In the recent past, Nigeria has received technical assistance from the IMF to develop a risk-based approach to AML/CFT supervision. This has resulted in the development of similar procedures across all regulatory authorities as well as the financial intelligence unit, namely the Central Bank of Nigeria, the Securities and Exchange Commission, the National Insurance Commission and the Nigerian Financial Intelligence Unit.The authorities are now engaging with the World Bank to undertake a national risk assessment to provide a basis for further developing the overall AML/CFT regime and strategic framework.The Presidential Committee is committed to continuing the coordination of this process.

“It will also be recalled that due to the listing of Nigeria as a high-risk jurisdiction by the FATF, many financial institutions treaded cautiously in transacting business with their Nigerian counterparts. However, following political commitment by President Goodluck Ebele Jonathan, particularly in the past two years, Nigeria fast-tracked its implementation of the mutually agreed Action Plan.

“This commitment was underscored when the President constituted a Cabinet Committee headed by Vice President Namadi Sambo to accelerate the delisting of Nigeria from the list of jurisdictions with outstanding issues with the FATF as they relate to Anti-Money laundering/Counter Financing Terrorism regimes.

“With today’s delisting, Nigeria and Nigerian businesses are now free from the repercussions of being labeled a non-cooperating and high-risk jurisdiction in the aspect of money laundering and terrorists financing. It is expected that there will be great reduction in the costs and time line of financial transactions between individuals and institutions between Nigeria and other countries.

Besides the guarantee of improved global rating for the country’s financial system, the amended laws and regulations will strengthen the enforcement and regulatory capacities of relevant institutions in Nigeria.”

•Photo shows Stephen Oronsaye, Chairman, Presidential Committee on Financial Action Task Force.