The Nigeria Deposit Insurance Corporation (NDIC) has reiterated that the Nigerian judiciary is a critical institution towards achieving the NDIC core mandate of depositor protection and its contribution to financial system stability.

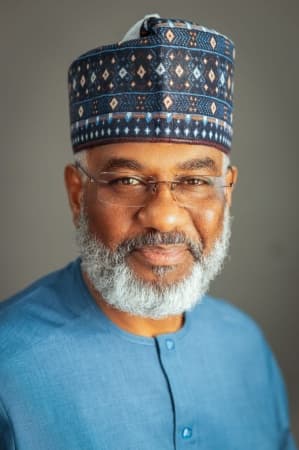

Managing Director and Chief Executive of the NDIC, Alhaji Umaru Ibrahim, stressed this at the opening ceremony of the Corporation’s 2015 Sensitization Seminar for Judges of States and Federal Capital Territory (FCT) High Courts in Abuja.

Alhaji Ibrahim was represented by the Corporation’s Executive Director Operations, Prince Aghatise Erediauwam at the seminar with the theme, “Challenges to Deposit Insurance Law and Practice in Nigeria”, attended by about 60 Judges of States and FCT High Courts.

The NDIC boss explained that the forum was intended to address the challenges being faced by the Corporation in its bid to successfullydischargeits mandate. He said that no matter how robust the NDIC’s extant laws, the Corporation needed the legal support from the judiciary to achieve its mandate. He added that the Corporation would continue to seek the cooperation and understanding of the judiciary, given that the judiciary is constitutionally vested with the powers of interpretation of statutes and laws in the Federation.

Alhaji Ibrahim enumerated some of the major challenges facing NDIC. These, he said, include the menace of protracted and complex bank liquidation related litigations as well as their attendant consequences, the execution of court judgments against the assets of the Corporation as the liquidator of failed banks and lack of proper understanding of its proper legal status on its role as a Deposit Insurer which is distinct from its status as a bank liquidator. He urged the participants to critically examine these challenges with a view to proffering a lasting solution in order to empower the Corporation to effectively discharge its mandate.

While declaring the seminar open, the Chief Justice of Nigeria and Chairman, Board of Governors of the National Judicial Institute, Hon. Justice Mahmud Mohammed, noted that some of the esoteric legal issues bordering on the established rights of creditors, shareholders and depositors of failed financial institutions were genuine matters before the courts. He, therefore, called for a clear and proper understanding of the concept and operation of bridge banks as well as the execution of assets of failed bankswithin the context of deposit insurance system (DIS). This, according to him, would facilitate better appreciation of the legal issues by the judiciary and eventually lead to more informed court judgments.

Hon. Justice Mohammed urged the participants to actively utilise the knowledge gained at the seminar in the course of their duties and also enjoined them to continue to uphold the highest standards of ethics and integrity.

•Photo shows NDIC MD/Chief Executive, Umaru Ibrahim.

NEWS EXPRESS is Nigeria’s leading online newspaper. Published by Africa’s international award-winning journalist, Mr. Isaac Umunna, NEWS EXPRESS is Nigeria’s first truly professional online daily newspaper. It is published from Lagos, Nigeria’s economic and media hub, and has a provision for occasional special print editions. Thanks to our vast network of sources and dedicated team of professional journalists and contributors spread across Nigeria and overseas, NEWS EXPRESS has become synonymous with newsbreaks and exclusive stories from around the world.